Why is Auto Insurance So Expensive in Louisiana? An Analysis of Louisiana’s Auto Insurance

November 14, 2023

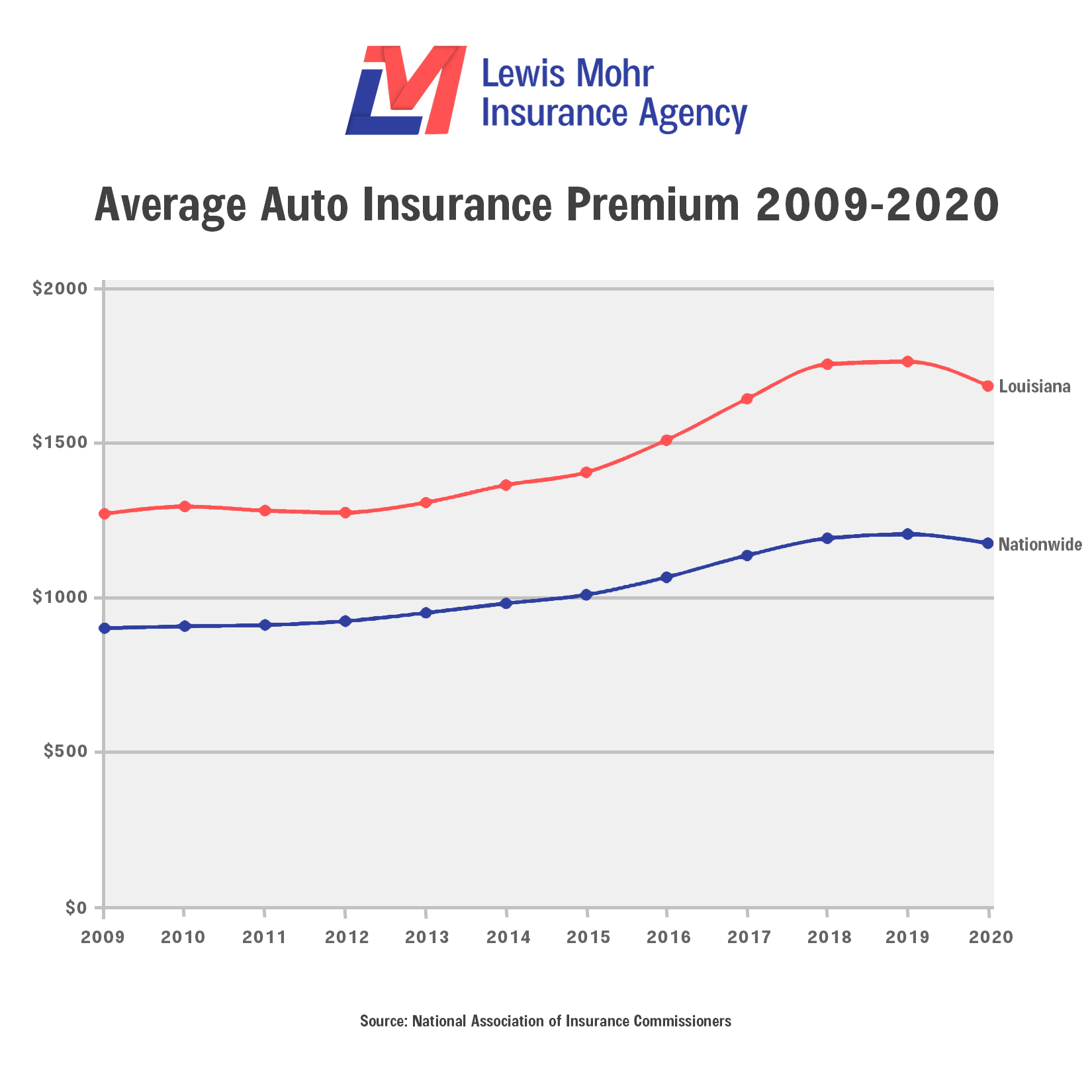

It’s no secret that Louisiana has battled high auto insurance premiums for decades. According to the National Association of Insurance Commissioners, Louisiana had the highest combined average premium (liability, comprehensive, and collision combined) from 2015 to 2020 and has been among the three highest states since 2006.

In 2020, Louisiana drivers paid an average premium of $1,684.86 compared to the national average of $1,176.81.

During the COVID-19 pandemic, insurance companies lowered premiums due to fewer cars on the road, but premiums have since risen above previous highs.

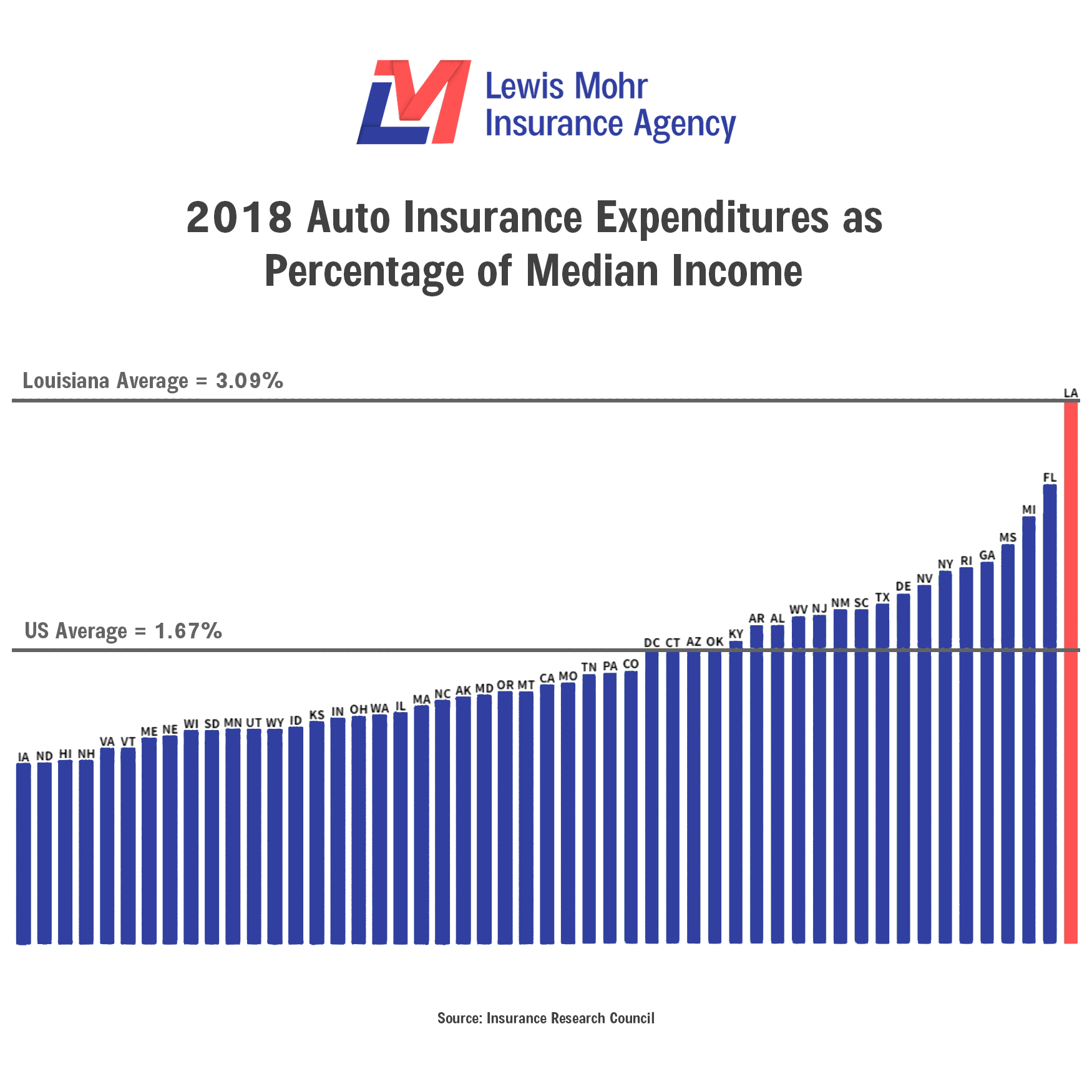

Auto Insurance Affordability

If we look at the affordability of auto insurance based on the median income of a state’s residents things look much worse for Louisiana. According to a 2021 study conducted by the Insurance Research Council, on average auto insurance expenditures make up 3.09% of Louisiana residents’ median income compared to the US average of 1.67%. That’s almost double the national average!

Why is Louisiana’s Auto Insurance So Expensive?

- High rates of uninsured and underinsured motorists: Louisiana has one of the highest rates of uninsured and underinsured motorists in the country. This means that more drivers on the road don’t have adequate insurance to cover the costs of an accident. Insurance companies pass these costs on to their policyholders in the form of higher premiums.

- High rates of distracted driving: Louisiana also has high rates of distracted driving, such as texting and driving. Distracted driving is a major cause of car accidents, and insurance companies charge higher premiums to drivers who are more likely to cause an accident.

- High rates of vehicle theft: Louisiana has higher rates of vehicle theft than many other states. This means that insurance companies have to pay out more claims for stolen vehicles, which drives up premiums for all drivers.

- Litigious environment: Louisiana is known for its litigious environment, and insurance companies often face higher legal costs in the state. These costs are also passed on to policyholders in the form of higher premiums.

What Can Be Done to Lower Auto Insurance Rates in Louisiana?

- Cracking down on uninsured and underinsured motorists: The state can take steps to crack down on uninsured and underinsured motorists, such as requiring all drivers to carry a minimum amount of insurance and making it more difficult for uninsured drivers to renew their registrations.

- Educating drivers about the dangers of distracted driving: The state can also educate drivers about the dangers of distracted driving and the importance of paying attention to the road.

- Reducing vehicle theft rates: The state can take steps to reduce vehicle theft rates, such as increasing police patrols in high-crime areas and implementing stricter penalties for vehicle theft.

- Reforming the state’s tort system: The state could also reform its tort system to make it less litigious. This could include limiting the amount of damages that can be awarded in personal injury lawsuits or requiring drivers to go through mediation before filing a lawsuit.

Louisiana’s high auto insurance rates are a major burden on residents. The state must take steps to address the factors that are driving up premiums to bring Louisiana in line with the rest of the nation. If you have questions about your insurance policies, please reach out by filling out our contact form or giving us a call. We are happy to help!