When Should Small Businesses Consider Switching Insurance?

February 6, 2024

Is your current insurance not cutting it? Not only is it important to evaluate your business’ insurance policy regularly to make sure you have the right coverage in place, but it’s important to make sure you are working with the right insurance company. In this blog post, we’ll look at why businesses switch insurance companies and the best way to go about doing it.

Why Switch Insurance Companies

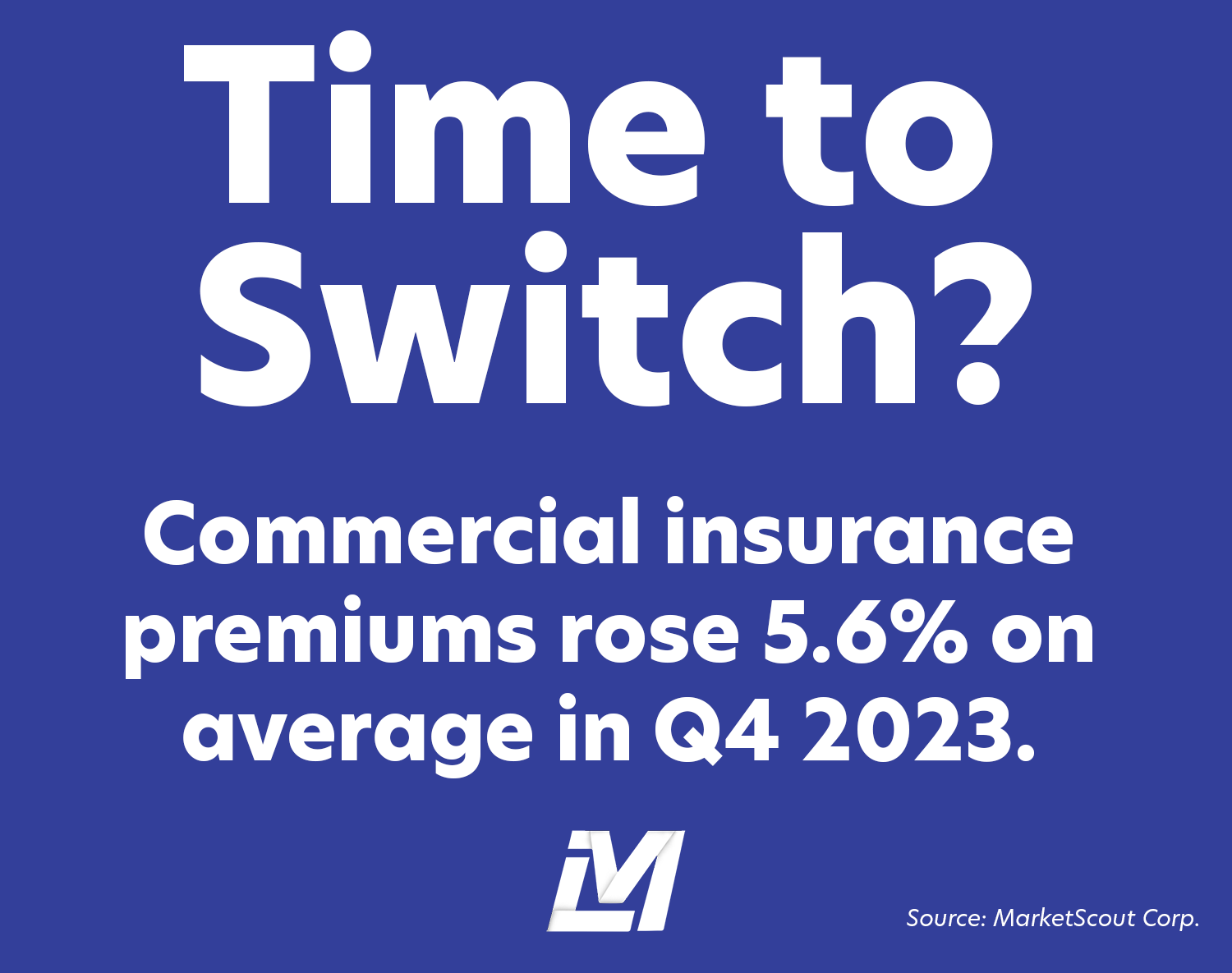

One of the main reasons businesses switch insurance providers is similar to other industries – to find a better rate. Even if you don’t end up finding a better rate, it can give you peace of mind to look at different companies to make sure you are getting the best rate possible.

Another reason small business owners switch providers is to accommodate changes to their insurance needs. As your business grows and changes, the insurance policies you need will change with it. Bundling policies with one insurance provider is often a good way to save money, but if your current provider doesn’t offer a policy you need, it may make sense to switch all your policies to a new provider.

One thing Louisiana businesses should consider is the limits and deductibles on their commercial property insurance policies. If your policy has adequate coverage, you might want to wait until the insurance market changes in Louisiana, as there are limited policies available.

How to Change Insurance Companies

The first step in changing your insurance provider is to analyze your current policy. You will want to determine what you’re currently covered for and how you’d like this to change. While it is always tempting to lower your coverage to reduce your premium, this can lead to higher costs in the long run due to high out-of-pocket costs on a claim.

Next, you’ll want to check your licensing and professional requirements. For example, some states require real estate agents to carry professional liability insurance or hospitals will require healthcare professionals to carry medical malpractice insurance to work at their facility. You’ll want to check the specific requirements for your business, but other common insurance requirements are:

- General liability insurance for general contractors

- Commercial property insurance to lease a business property

- Workers’ comp insurance for businesses with one or more employees

- General liability insurance to work at another business’ property

Lastly, you’ll want to review the new policy’s terms. This will include your premium, coverage limits, and deductible. One of the most important terms to look at is exclusions. Exclusions are the list of claims not covered by your policy. For example, flood coverage is not covered in a commercial property insurance policy and will need to be purchased separately if you want to be covered. Policy exclusions can differ between insurance providers so it’s important to review these in detail.

What You Should Do Before Switching

Before you switch insurance providers it is a good idea not to cancel your current policy too early. Your current provider could charge a cancellation fee if you cancel before your renewal date, so it is best to review your current policy first. Additionally, you’ll want to ensure your new policy will go into effect when your old policy expires, so you won’t have any gaps in your coverage.

While this may all sound like a lot to do while running your business, working with an independent insurance agency, like Lewis Mohr, can simplify the process. We will meet with you to understand your business’ unique needs and then shop your policy to find you the best rate. Plus, we continue to check your policies to make sure you have the best rate each time you renew coverage. Fill out our Get Insurance form to get started!