A Guide to Flood Insurance for Your Business

November 15, 2017

No state, region or community across the country is immune to floods. Many businesses in south Louisiana experienced this firsthand in August of 2016. By the numbers, this flood proves to be one of the most devastating natural disasters since Hurricane Sandy. The catastrophic flood caused an estimated $8.7 Billion in damage, and many businesses who were facing serious loss, were forced to close either temporarily or permanently. Businesses in Louisiana are a testament to how important it is to have flood insurance. Flood coverage allowed many small businesses to recover from their damages and get back to business.

Unless you have flood insurance, you’re faced with three choices for your business: paying recovery costs out of your own pocket, taking out a loan (thus incurring debt), or closing your doors- maybe even permanently. Unfortunately, many businesses are forced to choose the third option. At least 25% of small businesses never reopen following a natural disaster, and, as we know in Louisiana, just a few inches of flooding can cause thousands of dollars in damage. In this blog, we discuss the ins and outs of the National Flood Insurance Program’s flood coverage for business so you can be prepared.

The Types of Flood Insurance Coverage

Because business insurance policies do not cover damage from flooding, a separate flood insurance policy is necessary to protect your company. Most flood insurance is obtained through FEMA’s National Flood Insurance Program (NFIP), although there are some private policies available. There are two categories of commercial flood insurance:

Preferred Risk Policy

These are available to businesses in areas with a low to moderate risk of flooding. Preferred risk policy premiums are the lowest premiums available through the NFIP, offering insurance on both the building and its content in one low-cost policy. You could, however, choose to insure only the contents.

Standard Policy

This type of policy is available for businesses located in areas with a high risk of flooding. Standard policies insure the building and its contents separately.

What type of policy would your business qualify for? To determine this, you must understand your business’ risk.

Understanding Your Business’ Risk

The type of flood insurance policy you qualify for and how much you pay for that policy depends on your business’ risk. Your risk is largely determined by your business’ location on flood hazard maps, also known as Flood Insurance Rate Maps (FIRMs). The maps show the extent to which areas of a community or certain properties are at risk for flooding. The level of flood risk is indicated on the map by a letter. For example, flood zones labeled B, C, or X represent moderate to low risk areas. Flood zones represented by the letters A or V translate to high risk areas (also known as Special Flood Hazard Areas). Lastly, areas labeled with the letter Z means the flood risk is undetermined. By checking the map to see where your business falls, you can understand whether or not you are in a low, moderate, or high risk category.

It is important to remember that flood risks change over time; therefore, as your community’s flood map is updated, your business may fall into a higher risk than before. If you find your business newly mapped into a high risk area, the NFIP has flood insurance rating options to help reduce the financial impact. Conversely, if your business is no longer high-risk and instead moves to a moderate/low risk area, your existing policy can usually be converted to a lower cost policy with no gap in coverage. In either scenario, we encourage you to reach out to your insurance agent so you can be fully informed and make the best financial decision about protecting your business.

Understanding Your Policy’s Cost

How much will your flood insurance cost? Your business’ risk is just one factor that shapes your specific policy. In fact, there are various things that go into determining what your business’ flood insurance premium will be, including:

Flood Zone/Risk:

In general, higher risk zones equate to higher rates; so, your business’ risk of flooding according to the flood map will be reflected in the cost. However, elevation, floodproofing, and other mitigation efforts can often reduce that rate. Refer to Figure 1 for some ways to reduce your risk of flood damage.

Base Flood Elevation (BFE):

This is the elevation floodwaters are estimated to have a 1% chance of reaching or exceeding in a given year.

Lowest Floor Elevation (LFE):

This is elevation of the lowest floor of the lowest enclosed area, and is usually determined by a surveyor as part of obtaining an Elevation Certificate. The higher the LFE is above the BFE, the lower the risk is, resulting in a lower rate for your business.

Deductible:

As with car or homeowners insurance, choosing a higher deductible will lower the premium you pay, but will also reduce your claim payment. Deductibles as high as $50,000 for both building and contents are available, which could result in a 40% or greater discount on certain rates.

Construction Date:

If your business’ building was built before the first flood map went into effect, it is known as pre-FIRM and may receive subsidized rates. However, these are being phased out.

What’s Covered by Your Flood Insurance Policy

With both Preferred Risk Policies and Standard Policies, the NFIP offers coverage for:

Building Property

Building coverage includes the building and its foundation, electrical/plumbing/heating/cooling systems, and walk-in freezers.

Personal Property (also referred to as Contents Coverage)

For businesses, Personal Property refers to the content of your business. This coverage includes furnitures, machinery, fixtures, equipment, stock, and up to 10% of contents coverage for improvements and betterments.

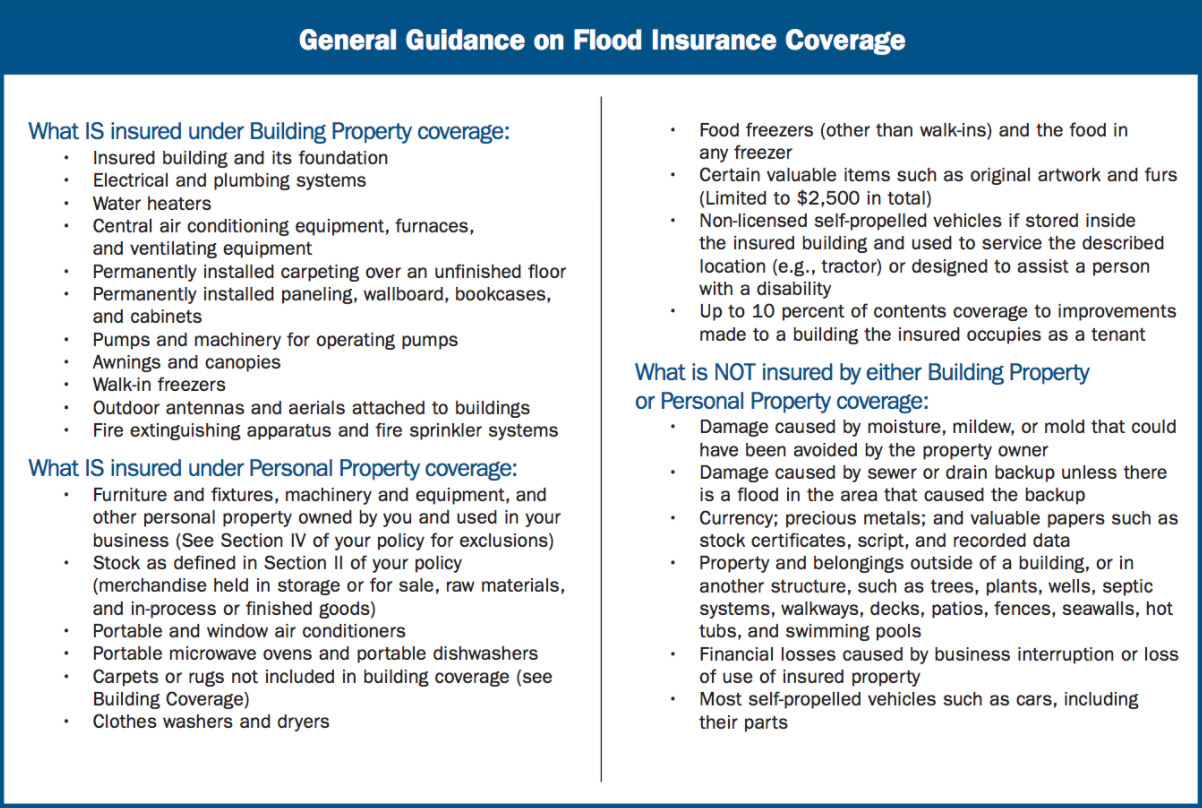

The following chart provides general guidance on items covered by flood insurance, and your specific policy will include a complete list.

Both building and personal property coverage cover up to $500,000 each. It is important to recognize that the value of flood losses at the time of the claim is based on the Actual Cash Value (depreciated cost), not the replacement cost.

Additionally, most NFIP policies include Increased Cost of Compliance coverage, which may apply to insured buildings when flood damages are substantial. Say your community declares your building substantially damaged or subject to repeat loss from flooding- this would require you to bring your structure up to current floodplain management building standards. This can be costly, but you may use ICC coverage to help cover these costs. ICC coverage provides up to $30,000 of the cost to elevate, demolish, relocate, or flood proof the building. Payment of the ICC claim is in addition to the amount of the building claim; however, the total of the two claims cannot exceed $500,000.

Note that a flood insurance policy does not provide coverage for business interruption or loss of use of the insured property, so you may consider discussing incorporating a separate business interruption policy into your business’ insurance strategy.

For information about your business’ specific limits of coverage and deductibles, refer to the Declarations page of your flood insurance policy. In addition, you should review your policy with your insurance agent or company representative.

For decades, we have been fortunate to help our clients get back on their feet and resume operations after flooding. We are here for you when you need it most; whether it’s understanding the intricacies of a flood policy or securing coverage for your business, we can help your company be prepared for a disaster and ready for recovery.